PSU banks announce 3-month moratorium on loan EMIs

Last week, the RBI had asked all lending institutions to allow a three-month moratorium on EMI payments in order to infuse liquidity into the system as the economy grapples with coronavirus challenges. It has also allowed banks for deferment of interest on working capital loans for the next three months – until June 2020.

Here is the list of banks which have announced the three months’ moratorium on all term loans, including home, auto and crop loans:

Union Bank of India: “We are extending COVID-19 Relief to customers to defer their instalments / interest falling due between 01/03/20 to 31/05/20 for 3 Months.”

Punjab National Bank: “PNB presents relief scheme for our customers. In view of COVID-19, it has been decided to defer payment of all installments on term loan and recovery of interest on cash credit facilities falling due between March 01,2020 and May 31 2020,” read a tweet by the bank.

IDBI Bank: IDBI has also extended the loan payment tenure for its customers by three months. It, however, said that borrowers whose cash flows are not impacted may continue paying the EMIs as per the schedule.

“IDBI Bank extends moratorium on Term Loan instalments/interest and deferment of interest on working capital loans of borrowal accounts impacted due to COVID 19 for 3 months.”

Bank of Baroda: “BankofBaroda is providing a moratorium of 3 months on payment of all instalments falling due between 01.03.20 & 31.05.20 for all term loans including Corporate, MSME, Agriculture, Retail, Housing, Auto, Personal loans, etc. in pursuance of the RBI COVID-19 Regulatory Package,” read a tweet by the bank.

“Interest during the moratorium period will continue to be accrued,” read another tweet.

Canara Bank: “In terms of Covid 19- RBI package, borrowers are eligible for moratorium/ deferment of installments/EMI for Term loans falling due from 01.03.2020 to 31.05.2020 & repayment period gets extended accordingly. SMS also has been sent to customers to avail the same.”

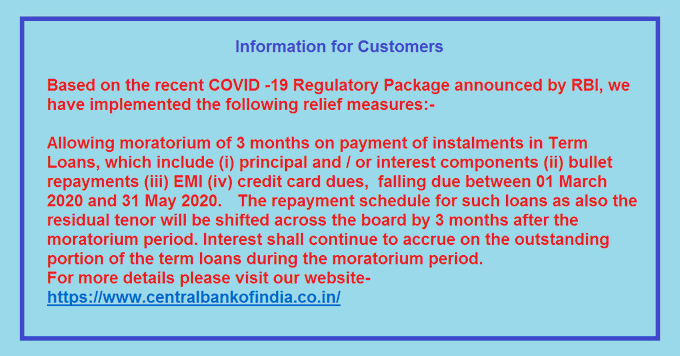

Central Bank of India:

Syndicate Bank: “EMIs of housing loan, vehicle loans, MSME loans and payment of all other term loans falling due after 1st March 2020 and upto 31st May 2020 have been deferred by 3 months,” the bank tweeted.

Indian Overseas Bank: “In terms of Covid 19- Regulatory Package, borrowers are eligible for moratorium/ deferment of installments/EMIs for Term loans falling due from 01.03.2020 to 31.05.2020.“

“In view of Covid 19 Regulatory package announced by RBI, Customers may contact their respective branch for deferring payment of loan instalments and interest on working capital,” the bank said in a tweet.

Banks said they have started sensitising their branches about three months’ moratorium on all term loans, including home, auto and crop loans, to help customers in overcoming financial difficulties due to the coronavirus outbreak and subsequent nation-wide lockdown.

They said they have informed and provided their branches with the detailed guidelines on various schemes announced by the RBI recently and customers are being sent messages individually on their registered mobile number about the EMI payment.

Following the directions by the RBI last Friday, the banks just had one working day to finalise the details and issue instructions to branches.

While several PSU banks have announced the deferment of loan payment schedule for the borrowers, private lenders are yet to make an official announcement on the RBI directives. However banks have cleared that If a borrower does not apply for the moratorium, then the bank may continue to auto debit the EMI. Borrowers who will opt for the three-month moratorium will have to pay an additional interest that will be charged on a simple interest basis. The interest will get accrued during the moratorium period and borrowers will have to pay the accrued interest along with their monthly payments from June onwards.